As we observe National Hispanic Heritage Month—a celebration of Americans with ancestors in Spain, Mexico, the Caribbean and Central and South America—we want to highlight how FHFA approaches race and ethnicity subgroup data. Latino Americans have historically faced barriers to homeownership, a problem that persists today for some Latino communities. Early land laws and other policies promoted segregation by race and ethnicity, enacted barriers to homeownership, and perpetuated the wealth gap.

Other obstacles Latinos face in the path towards homeownership include a lack of funds for a mortgage deposit. Lower down payments can result in higher interest rates and overall higher mortgage costs, which leaves less money for daily living expenses and savings for the future. Latinos who struggle with Limited English Proficiency (LEP) can also experience challenges to homeownership. Lenders are not required to provide oral translators for LEP individuals. And often, LEP borrowers will use their English-proficient child, who may not be familiar with mortgage lending terms, as a translator. As a result, this can leave the borrower without a full understanding of mortgage terms and conditions. Purchasing a home is a high-cost financial transaction that involves a great deal of liability; therefore, it is important that LEP borrowers have the same access and understanding of the home-buying process as non-LEP borrowers.

In May of 2018, FHFA, Fannie Mae and Freddie Mac launched the Mortgage Translation clearinghouse. This online resource provides a repository of translated documents and tools to help mortgage industry professionals and LEP borrowers navigate the home-buying process. The collection now includes translated documents in Spanish, traditional Chinese, Vietnamese, Korean and Tagalong. The clearinghouse also offers a list of industry resources who can provide oral interpretation services to borrowers at no-cost. Furthermore, in an effort to create consistent terminology and simplify translations for documents, FHFA, in collaboration with the Consumer Financial Protection Bureau, Fannie Mae and Freddie Mac, established standardized glossaries for each translated language.

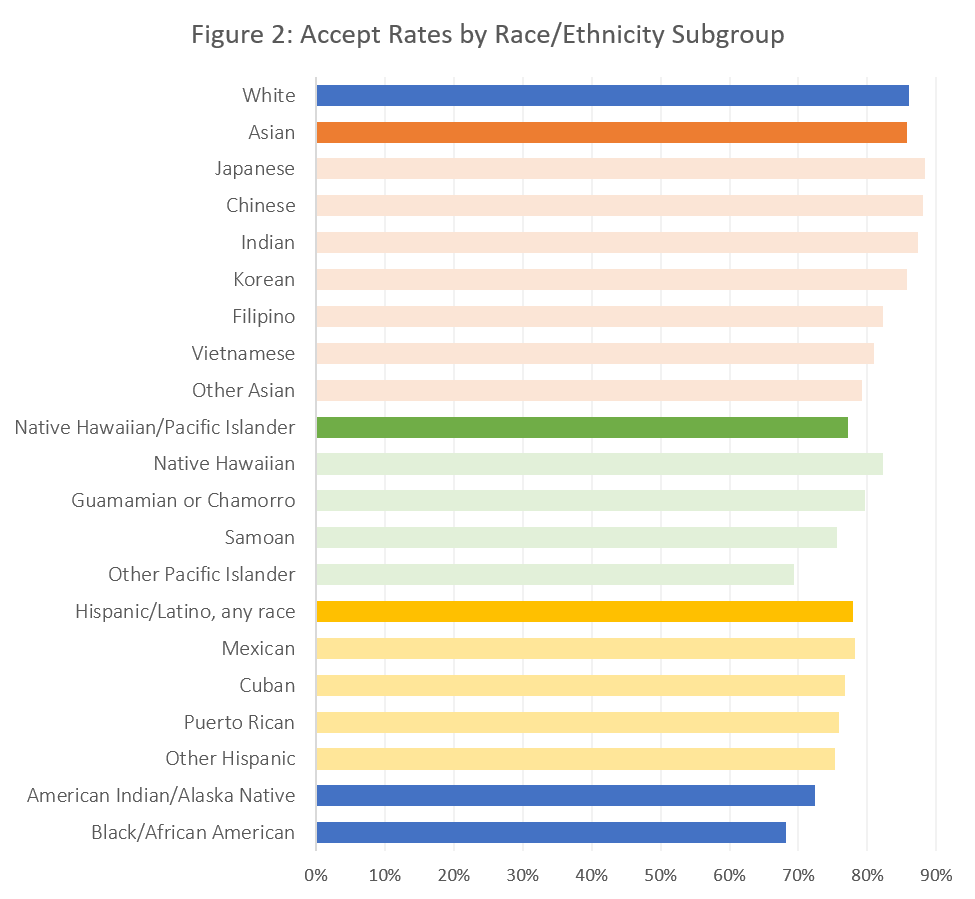

Latino American subgroups, as well as Asian American and Pacific Islander subgroups, are often aggregated during data analysis. In some cases, Asian American and Pacific Islanders, and American Indian and Alaska Natives are simply categorized as “other.” This is often due to the small sample size. These communities are far from monolithic, representing distinct cultures, immigration patterns and American experiences. Changing borders and immigration laws and policies have drastically shaped these populations by limiting when and under what circumstances migration and naturalization occurred. Both Latino Americans and Asian Americans have historically faced barriers to homeownership, a problem that continues today for some communities.

Recently, the Office of Fair Lending Oversight within the Division of Housing Mission and Goals and the Division of Research and Statistics collaborated on a data analysis designed to highlight these differences. Specifically, we disaggregated data to the furthest extent possible in order to uncover trends and potential disparities that are often hidden in aggregated numbers.

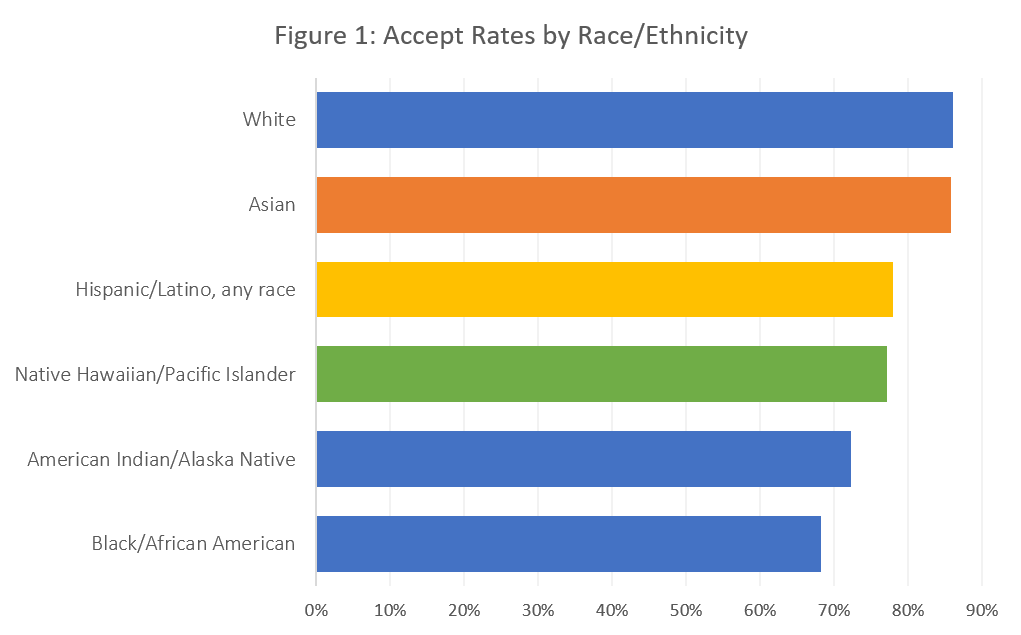

To demonstrate, we conducted analysis using the 2020 Home Mortgage Disclosure Act (HMDA) data published by the Consumer Financial Protection Bureau. Our analysis includes all single-family conventional and conforming loans. Figure 1 illustrates approval rates (for mortgage loans) by race and ethnicity groups.

Figure 2 presents the same information with additional subgroup context. Subgroup information provides additional context for analyzing race and ethnicity data and highlights the challenges certain Latino, Asian, and Pacific Islander groups face in accessing mortgage credit. It also underscores the diversity of the American experience.

For Latino communities, we note that Mexican applicants have slightly higher approval rates than Latinos as a whole, but Puerto Rican and “Other Hispanic” applicants have lower approval rates. Among Asian-Americans, the Vietnamese, Filipino and “Other Asian” communities experience lower approval rates than white applicants, despite Asians, as a whole, having similar approval rates as white applicants. Similarly, when the Pacific Islander group is disaggregated, it becomes clear that Samoan and “Other Pacific Islander” applicants have significantly lower approval rates than Native Hawaiian and Chamorro applicants.

Source: FHFA