Of late, there have been questions around two statistics surrounding women purchasing homes: why women are more likely than men to buy homes, and how their financials compare to those of single men buying homes. The answers are worth looking into.

Women have been second only to married couples in the home-buying market since the National Association of REALTORS® (NAR) started data collection on the topic in 1981. What is striking about this statistic is that it wasn’t until 1974 that women had federal protection, enabling them to obtain a mortgage without a co-signer. Prior to the passage of the Fair Housing Act’s prohibitions against sex discrimination in housing-related transactions, and the protections of the Equal Credit Opportunity Act, it was commonplace for a woman to need a male relative as a co-signer. Women had no legal recourse under federal law for this or any other kind of lending discrimination.

In 1981, 73% of homebuyers were married couples, 11% were single women and 10% were single men. Today, those shares stand at 60% married couples, 19% single women and 9% single men. Single-women buyers held their highest share of the market in 2006 at 22%. After 2006, the share of single-women buyers dropped incrementally to a recent low of 15% in 2015. In 2010, the share of single men rose to a high of 12% but has stayed in recent years between 7% to 9% of buyers.

An easy explanation for the rise in single-women buyers is the drop in the share of Americans who are married. Using Census data, in 1990, 59% of the American adult population was married. Today, that number stands at just 52%. Comparing the chart of recent homebuyers with that of the overall population, the trends mirror one another.

But then why are women buying homes and men are not? For that answer, it is best to turn to who is buying and their motivation for buying. Both male and female buyers are most likely to say they are purchasing for the desire to own a home of their own, but then nearly twice as many women say they’re purchasing a home to be close to friends and family. When NAR collects data on whether a buyer is single or married, one data point not collected is whether the buyer was once married and is now widowed or divorced. In both scenarios, the proximity to friends and family may be important to women.

Looking at the composition of the household also helps to tell the story. Single-women buyers are more likely to purchase a home with a child under the age of 18 and are more likely to purchase a multi-generational home (housing adult siblings, adult children and/or grandparents). These family obligations may make purchasing a home more attractive to a single-woman buyer, as she has the need for stable housing on a continual basis.

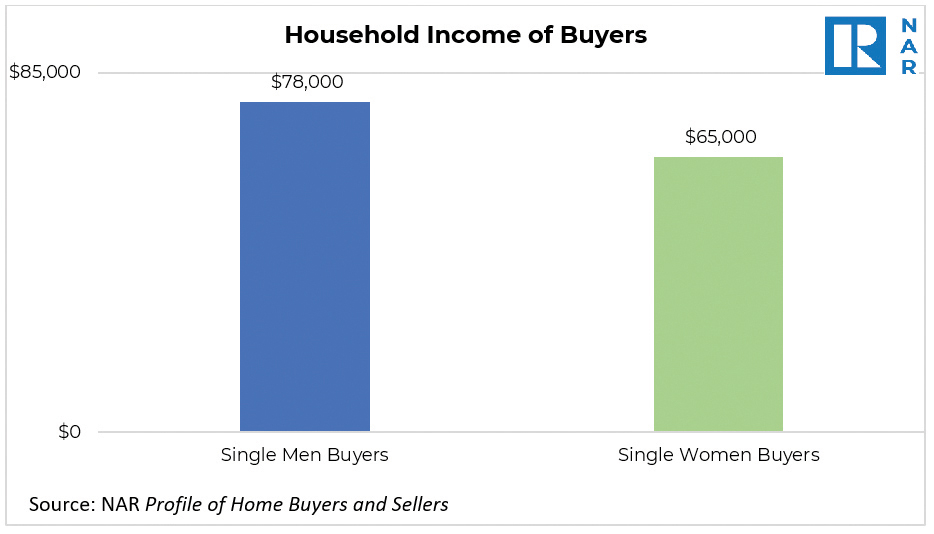

The second major question posed is related to finances. Single-women homebuyers typically purchase a home at a household income of $65,000 compared to single men at $78,000. While the median male income does not match that of married couples or unmarried couples, single-men buyers do have more buying power than single-women buyers.

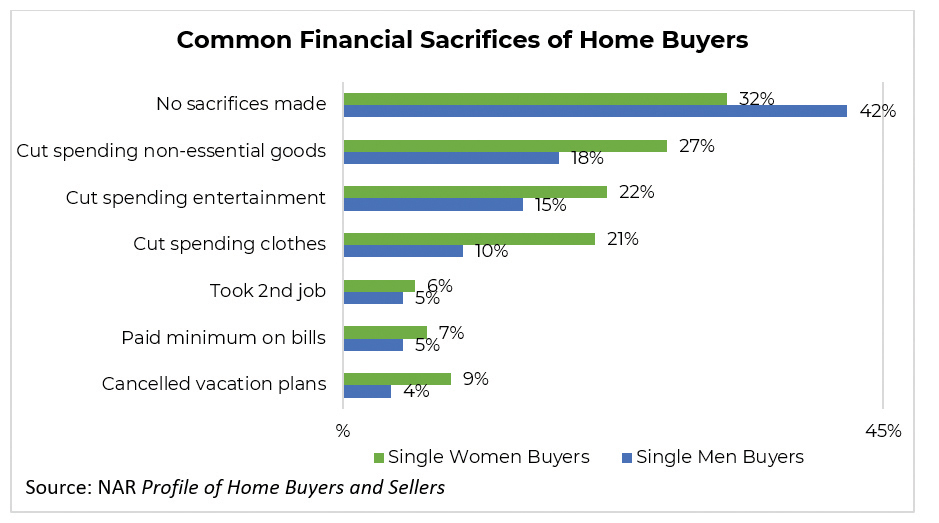

Given the financial pressures of children within the home and their lower household income, it’s no surprise that women make more financial sacrifices when purchasing. Forty-two percent of women who purchase a home say they have made financial sacrifices to do so compared with 32% of men who purchase homes. Common financial sacrifices include cutting spending on non-essential goods, entertainment and clothes, and canceling vacation plans. These sacrifices only underscore how important homeownership is to women. These sacrifices may add up and happen over a number of years. Among all buyers, single women are a median age of 51 compared to single men at 45. First-time women buyers are a median age of 34 compared to men at 31.

When women do purchase homes on their own, they are likely to purchase homes that are at a lower price point compared with those of single-men buyers. The median purchase price for single men was $249,000 last year compared to $230,000 for single women. While the price difference may not be a gamechanger for an individual buyer, in an environment where prices are experiencing double-digit year-over-year gains and inventory is historically low, finding an affordable property for oneself and possible dependents could be arduous. Still, women are in the market, successfully making home purchases.

For more on these trends and others, check out the full Profile of Home Buyers and Sellers report at www.nar.realtor/research-and-statistics/research-reports/highlights-from-the-profile-of-home-buyers-and-sellers.

Dr. Jessica Lautz is vp of demographics and behavioral insights for the National Association of REALTORS®.

Dr. Jessica Lautz is vp of demographics and behavioral insights for the National Association of REALTORS®.