The Federal Reserve Board recently reported that consumer credit outstanding rose by a seasonally adjusted annual rate of 5.7 percent, $193.0 billion, in May 2015, slower than the 7.6 percent rate of growth recorded in April 2015. Consumer credit outstanding now totals $3.401 trillion.

The expansion of total consumer credit outstanding partly reflected an increase in the outstanding amount of non-revolving consumer credit. Non-revolving consumer credit includes auto loans and student loans. According to the report, non-revolving credit outstanding grew by a seasonally adjusted annual rate of 7.0 percent, $174.0 billion, in May 2015, 0.8 percentage points faster than the 6.2 percent growth rate recorded in April 2015. There is now $2.500 trillion in outstanding non-revolving credit.

The increase in total consumer credit outstanding also reflected an expansion in revolving credit outstanding. Moreover, the slowdown in growth of consumer credit outstanding resulted from the deceleration in revolving credit outstanding. Revolving credit outstanding, largely composed of consumer credit card debt, grew by a seasonally adjusted annual rate of 2.1 percent, $19.0 billion, in May 2015, 9.4 percentage points slower than the 11.5 percent growth rate recorded in April 2015. There is now $901.0 trillion in outstanding non-revolving credit.

A previous post illustrated that the federal government is the largest holder of non-revolving credit outstanding. According to the Federal Reserve Board, non-revolving credit held by the federal government includes student loans, both originated and purchased. However, finance companies are also a large holder of non-revolving credit. At the end of 2014, finance companies were the second largest holder of non-revolving credit. Since the end of 2014, second place flips between finance companies and depository institutions.

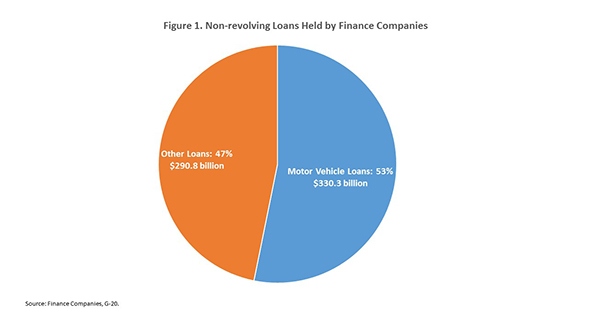

Although the holdings of depository institutions are split roughly evenly between non-revolving and revolving credit outstanding, the vast majority of consumer credit outstanding held by finance companies is non-revolving credit. The Federal Reserve’s G.20 release on Finance Companies decomposes non-revolving credit outstanding held by finance companies into motor vehicle loans and other consumer loans. Other consumer loans include student loans, personal cash loans, mobile home loans, and loans to purchase other types of consumer goods such as appliances, apparel, boats, and recreation vehicles. As of April 2015, the last month of data, motor vehicle loans, $330.3 billion, accounted for 53 percent of non-revolving loans outstanding held by finance companies and other loans, $290.8 billion, accounted for 47 percent.

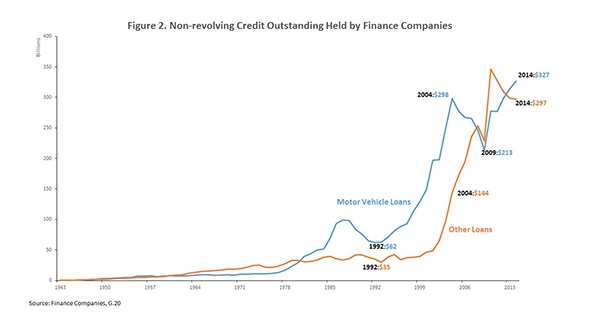

The near even split between motor vehicle loans and other loans held by finance companies was not always the case. Between 1992 and 2004, motor vehicle loans accounted for the vast majority of growth in non-revolving credit held by finance companies. Between 2004 and 2009, the outstanding amount of motor vehicle loans held by finance companies shrank while the outstanding amount of other loans soared. In 2009, the outstanding amount of other loans rose sharply, but has declined since then, while the outstanding amount of motor vehicle loans has more than recovered from the decline that ended in 2009 and it now exceeds its last peak level recorded in 2004.

As shown in Figure 2, between 1992 and 2004, the outstanding amount of other loans rose by 307 percent, but the outstanding amount of motor vehicle loans grew faster, expanding by 381 percent over the same period. At the end of 2004, motor vehicle loans accounted for 67 percent of non-revolving loans held by finance companies and other loans accounted for the rest, 33 percent. However, between 2004 and 2009, the outstanding amount of auto loans fell by 28 percent while other loans increased by 59 percent. At the end of 2009, motor vehicle loans accounted for 48 percent of non-revolving loans held by finance companies and other loans accounted for the rest, 52 percent. Since 2009, motor vehicle loans outstanding rose by 53 percent and now exceed their 2004 level. Meanwhile, other loans have risen by 30 percent, reflecting a sharp rise in 2010 and then a decline between 2011 and 2014. Announced on September 21, 2012, the one-year increase in other loans in 2010 reflects revisions to the finance companies data back to December 2010 made to incorporate the statistical results from the 2010 finance companies survey.

View this original post on NAHB’s blog, Eye on Housing.