In a joint release the Census Bureau and Department of Housing and Urban Development reported that the seasonally adjusted annual pace of housing starts in August was 956 thousand. This is 14.4 percent below the July pace of 1.117 million starts but the report is better than it looks because the decline was mainly concentrated in the highly volatile multifamily sector. The better indicator of the health of the housing recovery is the single family sector which was basically flat.

In a joint release the Census Bureau and Department of Housing and Urban Development reported that the seasonally adjusted annual pace of housing starts in August was 956 thousand. This is 14.4 percent below the July pace of 1.117 million starts but the report is better than it looks because the decline was mainly concentrated in the highly volatile multifamily sector. The better indicator of the health of the housing recovery is the single family sector which was basically flat.

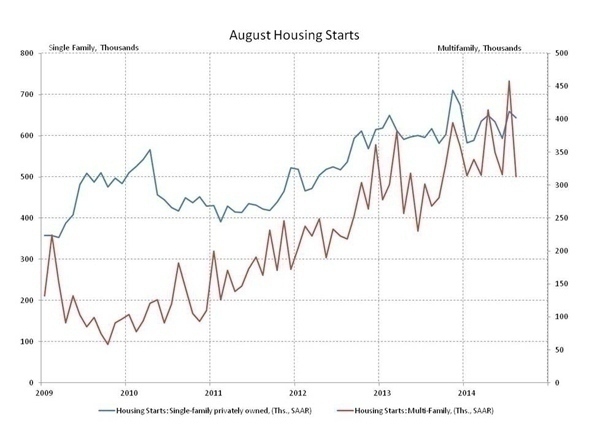

Multifamily starts in August came in at annual pace of 313 thousand, down from 458 thousand in July, a decline of 31.7 percent. Multifamily starts have swung between below 300 thousand and over 400 thousand for the last 18 months, so the August decline following a July run-up is no surprise. Despite the volatility, the trend in multifamily starts has been solidly upward, averaging 352 thousand so far in 2014 after averaging 309 thousand in 2013.

In contrast, single family housing starts in August were at an annual pace of 643 thousand, down slightly (-2.4 percent) from the July pace of 659 thousand. Single family starts have had a bumpy 2014 owing to last summer’s interest rate spike followed by a harsh winter, but with all the slowdowns and catch-ups starts have hovered around the 600 thousand to 650 thousand range in the first eight months of the year. Single family starts have rebounded to an average pace of 636 thousand since averaging 586 thousand in January and February. We expect the pace of single family starts to continue strengthening through the end of this year and next as the pace of starts climbs to a more normal level, reaching 1.2 million in the second half of 2016.

Housing market analysts will be closely watching progress in the second half of the year with particular interest in how impending interest rate increases will affect the recovery. The Federal Open Market Committee (FOMC), the Fed’s monetary policy setting arm, announced yesterday another reduction in its asset purchasing program and its intent to end purchases entirely after their October meeting, assuming no deterioration in economic conditions (FOMC).

We anticipate the impact on mortgage rates will be modest with fixed rate mortgages moving up but remaining below 6 percent as we enter 2016, keeping these rates highly competitive by historical standards. Today’s housing starts report may not look impressive on the surface but sows the seeds for continuing strength as we move through the remainder of the year.

Read this original post on NAHB’s blog, Eye on Housing.