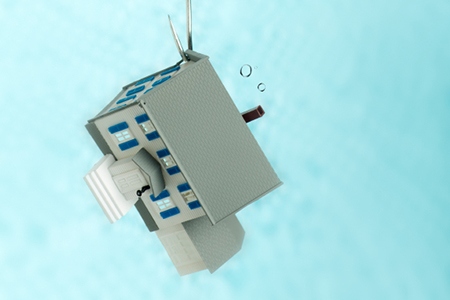

Eleven percent of homeowners are underwater, or owe more on their mortgages than their homes are worth, according to Zillow®’s third quarter Negative Equity Report—a figure that continues to gradually decline as the market moves in on recovery.

“As the housing market recovers and home values rise, the number of homeowners underwater on their mortgages continues to drop,” says Zillow Chief Economist Svenja Gudell. “In addition to the individual homeowners who are underwater, negative equity affects the housing market as a whole, so this is good news not only for these owners, who are now able to either sell their home or at least regain some financial stability, but also for buyers who may find more options now. I expect homes will gain value steadily, for solid economic reasons, and that negative equity rates will continue to fall.”

A hedge above 5 million homeowners were in negative equity in the third quarter, per Zillow’s report, compared to the 15.7 million underwater in the first quarter of 2012. Negative equity persists in Chicago, Ill., and Las Vegas, Nev., where 17 percent and 16.8 percent, respectively, of homeowners were underwater. The markets with the least negative equity, conversely, are San Jose, Calif., San Francisco, Calif., Portland, Ore., Denver, Colo., and Dallas, Texas, where less than 5 percent of homeowners were underwater.

Underwater homeowners can’t refinance to take advantage of still-low mortgage rates, and they can’t sell their homes except in short sales, which keeps their homes off the market. They may also find it difficult to cover the costs of selling, such as agent fees, closing costs and a new down payment, if they are buying a new home—a circumstance known as “effective negative equity.”

For more information, please visit www.zillow.com.

For the latest real estate news and trends, bookmark RISMedia.com.