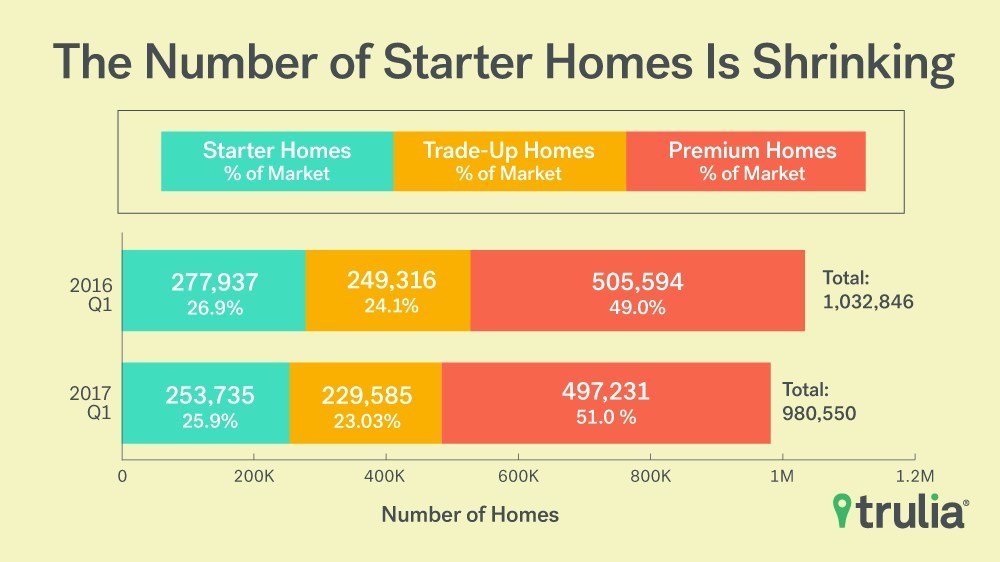

Housing inventory hit a new low in the first quarter of 2017, bottoming out from the early days of the recovery from the recession, according to Trulia’s recently released quarterly Inventory and Price Watch. Supply overall fell 5.1 percent year-over-year, dragged down by an 8.7 percent decrease in starter home supply and a 7.9 percent decrease in trade-up supply. Premium supply dribbled down just 1.7 percent.

“Recovering home values have proven to be a double-edged sword,” says Ralph McLaughlin, chief economist at Trulia. “While homeowners across the country are thrilled to regain equity in their homes, many have not been in a hurry to trade up. This has added to the inventory gridlock that ties up would-be starter home inventory from ever coming on to the market, further constraining supply and decreasing affordability.”

The starter home squeeze is being felt by first-time homebuyers, who, given the current supply, have to spend more of their monthly earnings to afford an entry-level home: 38.8 percent. The median list price of a starter home in the first quarter of the year was $166,015.

“Saving up for a down payment is one of the biggest obstacles to homeownership for first-time buyers,” McLaughlin says. “In markets plagued with tight inventory and decreasing affordability, millennials who make up most of these first-time buyers may find homeownership increasingly out of reach. However, there continues to be an uptick in new construction, which should help increase supply in some inventory-constrained markets.”

Source: Trulia

For the latest real estate news and trends, bookmark RISMedia.com.