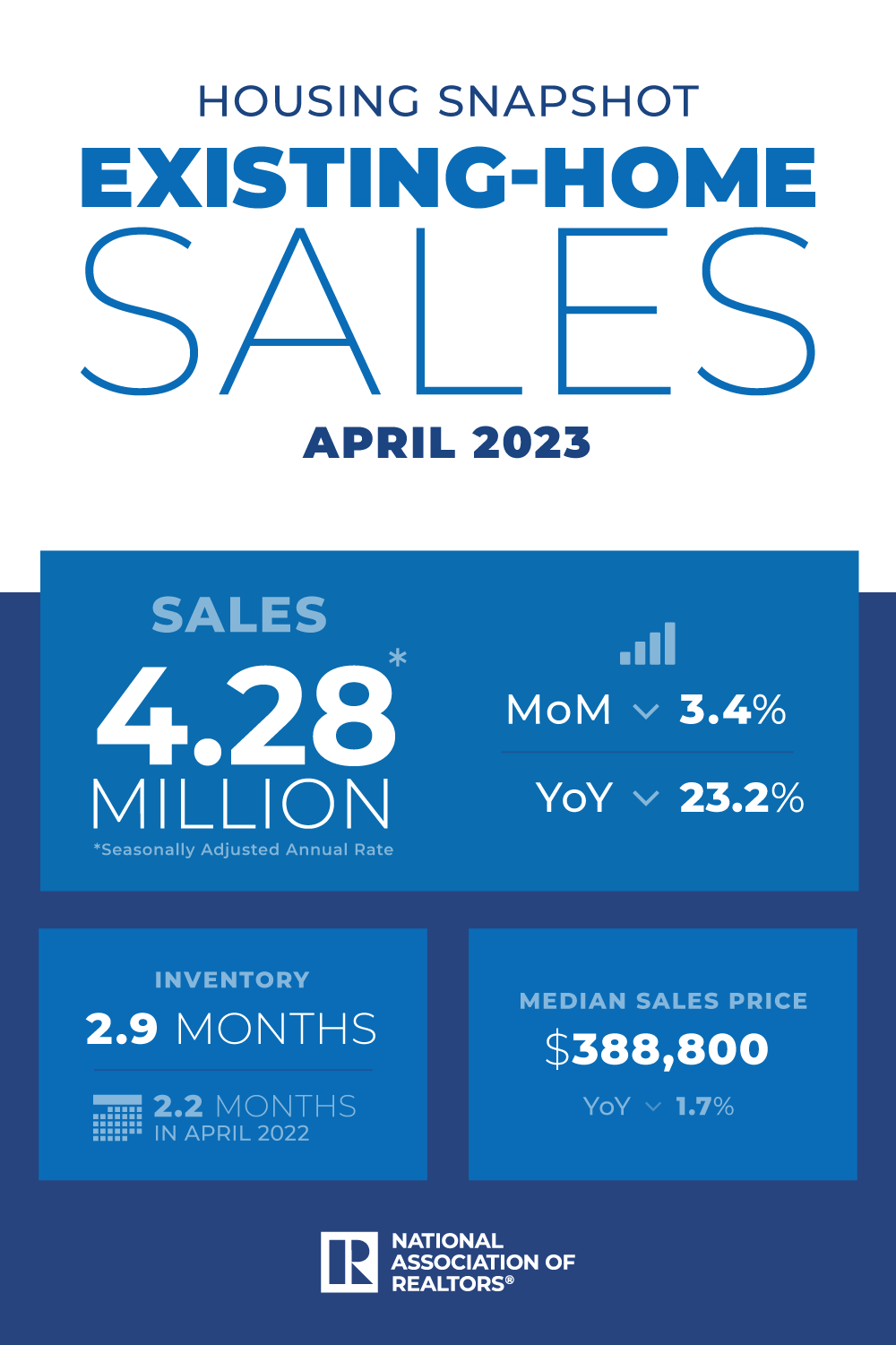

Existing-home sales dropped 3.4% from March to a rate of 4.28 million in April, according to the National Association of REALTORS®’ (NAR) most recent existing-home sales report.

NAR’s latest data on existing homes for April found that year-over-year, sales fell by 23.2%, down from 5.57 million last year. Additionally, all four major regions registered month-over-month and year-over-year sales declines.

Key data points:

- Total housing inventory was at 1.04 million units, up 7.2% from March and 1% YoY. Unsold inventory sits at a 2.9-month supply at the current sales pace, up from 2.6 months in March and 2.2 months last year.

- The median existing-home price for all housing types was $388,800, a decline of 1.7% YoY.

- Properties typically remained on the market for 22 days, down from 29 days in March, but up from 17 days last year. Seventy-three percent of homes sold were on the market for less than a month.

- First-time buyers were responsible for 29% of sales, up from 28% both last month and last year.

- All-cash sales accounted for 28% of transactions, up from 27% in March and 26% last year.

- Individual investors (or second-home buyers), who make up many cash sales, purchased 17% of homes in April, identical to March and one year ago.

- Distressed sales—foreclosures and short sales—represented 1% of sales in April, unchanged from last month and the prior year.

Single-family and condo/co-op sales:

- Single-family home sales were at 3.85 million, down 3.5% from 3.99 million in March and 22.4% YoY. The median price was $393,300, down 2.1% YoY.

- Existing condo and co-op sales were at 430,000 units, down 2.3% from March and 29.5% YoY. The median price was $348,000, a year-over-year increase of 0.7%.

Regional breakdown:

- Sales in the Northeast receded 1.9% to 510,000, down 23.9% YoY. The median price was $422,700, up 2.8% YoY.

- In the Midwest, sales declined 1.9% to 1.02 million, dropping 21.5% YoY. The median price was $287,300, up 1.8% YoY.

- Sales in the South decreased 3.4% to 1.98 million, a 20.2% decline YoY. The median price was $357,900, down 0.6% YoY.

- In the West, sales slipped 6.1% to 770,000, down 31.3% YoY. The median price was $578,200, down 8.0% YoY.

Major takeaways:

“Home sales are bouncing back and forth but remain above recent cyclical lows,” said NAR Chief Economist Lawrence Yun. “The combination of job gains, limited inventory and fluctuating mortgage rates over the last several months have created an environment of push-pull housing demand.”

Yun added, “Roughly half of the country is experiencing price gains. Even in markets with lower prices, primarily the expensive West region, multiple-offer situations have returned in the spring buying season following the calmer winter market. Distressed and forced property sales are virtually nonexistent.”

“Sales of existing homes fell in April as buyers struggled to find homes that were a good fit for their needs and their budgets,” said realtor.com® Chief Economist Danielle Hale. “After an upswing in February, mortgage rates eased in March, when many of the offers for homes sold in April would have been submitted. Nevertheless, average mortgage rates in March were about 25 basis points higher than in February, providing a modest additional headwind for buyers navigating still-high home prices. The pace of home sales continues to exceed the 4 million sales low reached in January, and still lags year ago sales by a considerable amount.

“As buyers navigate housing affordability, a dip in home down payments suggests two things: 1. it’s getting harder for buyers to keep up with costs; and 2. a less competitive housing market is opening up opportunities for buyers who are making somewhat smaller down payments. As is the case for many housing indicators, however, the point of comparison is important. Down payments are still considerably larger than was common before 2020.

The real estate market is a glass half-full, half-empty story for first-time homebuyers. A drop in market competitiveness and easing down payments open the door a bit wider, but the hurdles to entry are still quite high for first-timers who don’t have existing home equity to leverage for a down payment. Data show that on balance, the optimistic factors pushed first-time homebuyer share up to 28% in April from 27% in March and 26% one year ago—one bright spot amid the market’s challenges.”

For the full report, click here.

For the full report, click here.