It was never the avocado toast and cappuccino. The joke of millennials not buying homes in favor of overpriced coffee is an entrenched myth. It is important to break down what is really going on, what the numbers are and what the measures mean.

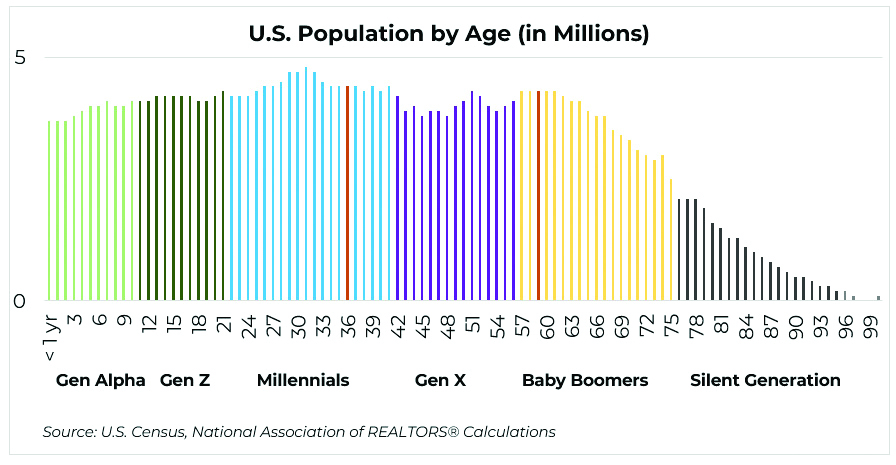

Looking at the U.S. population by age group (see chart to right), one can see that millennials are the largest generation of Americans ever. The red line represents the age of 36, which is the median age of today’s first-time homebuyers. This is the oldest seen since the National Association of REALTORS® (NAR) started collecting data on the age of buyers in 1981. Traditionally, the data has shown that the typical first-time buyer was between the ages of 28 and 33. (The second red line, at age 59, marks the median age of repeat buyers.)

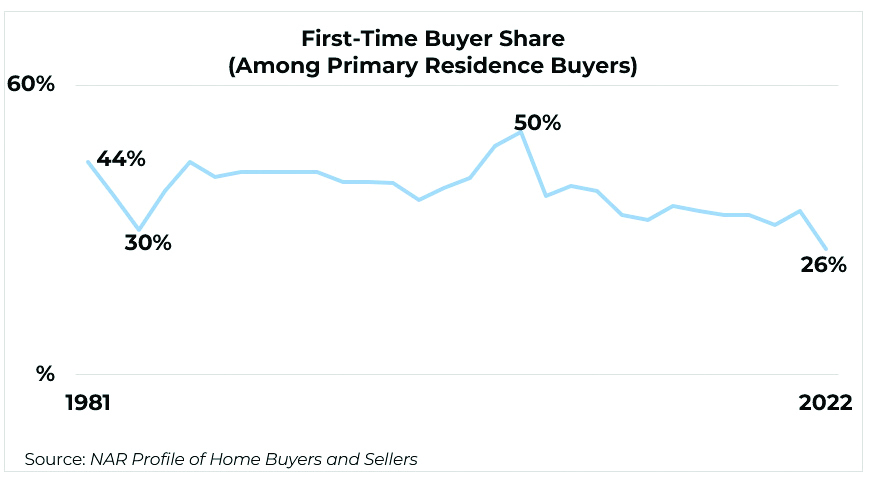

At the same time that the median age of first-time buyers has jumped, their share of the market is at historic lows. In 2023, first-time buyers made up just 26% of the primary residence market, while the historical average is 40%, dating back to 1981.

Low housing inventory, which has averaged nearly 1 million units in the market, is a factor. Today’s higher interest rates are pricing some consumers out. In many areas of the country, home prices are rising. Areas where home prices have softened tend to be where multiple bids pushed up prices throughout the pandemic.

Low housing inventory, which has averaged nearly 1 million units in the market, is a factor. Today’s higher interest rates are pricing some consumers out. In many areas of the country, home prices are rising. Areas where home prices have softened tend to be where multiple bids pushed up prices throughout the pandemic.

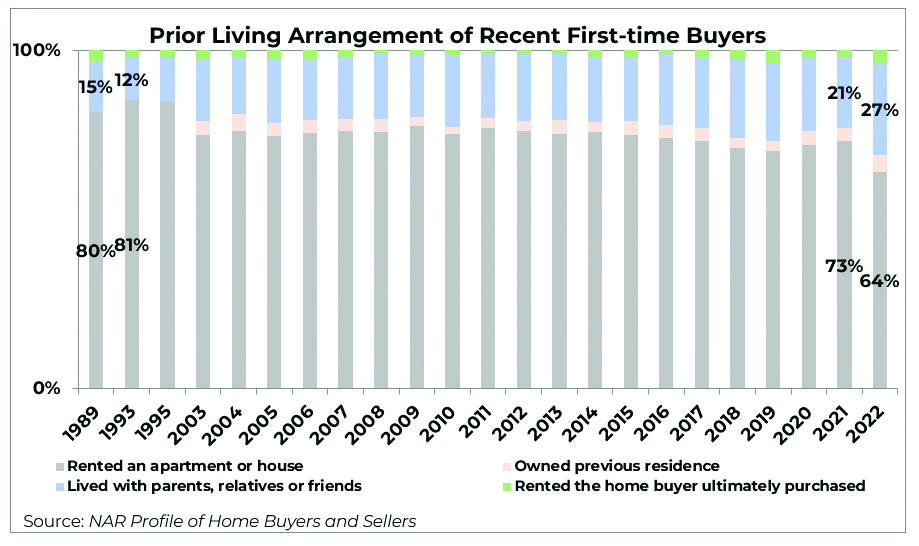

Even among successful first-time buyers, multiple debts made it difficult for them to save for a down payment. Among those who said saving for a down payment was difficult, the most-cited hurdles were high rent (40%), car loan (39%), credit card debt (38%), student loans (35%) and childcare costs (19%). The recent softening in rental prices will be a welcome relief to some moving forward. Twenty-seven percent of successful first-time buyers in 2022 skipped rent and moved directly from a family member’s home into homeownership. This is the highest share recorded by NAR since 1989.

It’s worth noting that student debt was cited as one of the top four reasons buyers had trouble saving for a down payment at a time when student debt payments were paused for many loan holders. Even with the pandemic pause, student loan holders may have been reticent to take out a mortgage, knowing payments could resume. A smaller share of buyers cited childcare costs, but for those who are paying for childcare, the cost can be daunting. In fact, it has increased 220% since 1990, and was $883 per month on average for one child in 2021.

It’s worth noting that student debt was cited as one of the top four reasons buyers had trouble saving for a down payment at a time when student debt payments were paused for many loan holders. Even with the pandemic pause, student loan holders may have been reticent to take out a mortgage, knowing payments could resume. A smaller share of buyers cited childcare costs, but for those who are paying for childcare, the cost can be daunting. In fact, it has increased 220% since 1990, and was $883 per month on average for one child in 2021.

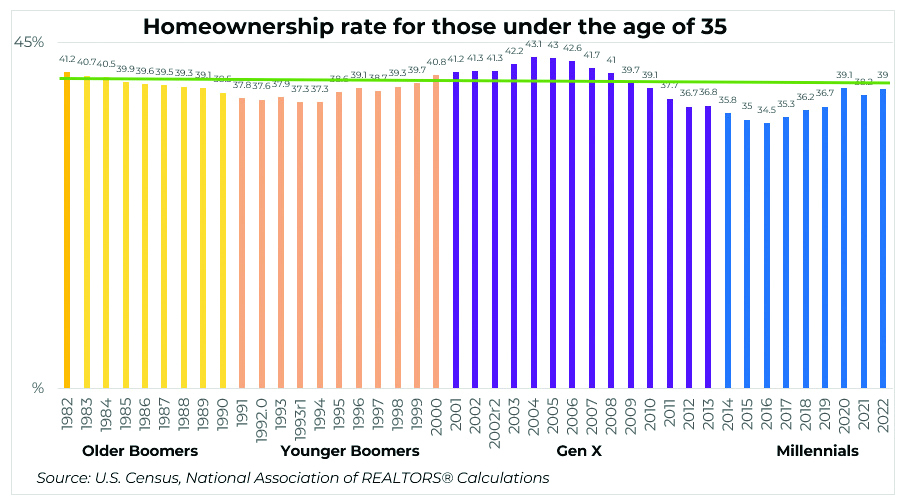

So with that bleak picture, where is the homeownership rate for those under 35? Census data provides a consistent reading of the homeownership rate by age, though this does not match directly to generational trends. When looking at the Census homeownership-rate data, there have been positive reports that the rate improved for those under 35. This is true. From 2021 to 2022, the homeownership rate did improve.

So with that bleak picture, where is the homeownership rate for those under 35? Census data provides a consistent reading of the homeownership rate by age, though this does not match directly to generational trends. When looking at the Census homeownership-rate data, there have been positive reports that the rate improved for those under 35. This is true. From 2021 to 2022, the homeownership rate did improve.

However, if one compares the homeownership rate from 1982 to today, and then separates the data by generation, it tells a less positive story. For baby boomers and Gen Xers, the average homeownership rate for those under 35 was 39.7%. There has yet to be a year that millennials have reached that number.

However, if one compares the homeownership rate from 1982 to today, and then separates the data by generation, it tells a less positive story. For baby boomers and Gen Xers, the average homeownership rate for those under 35 was 39.7%. There has yet to be a year that millennials have reached that number.

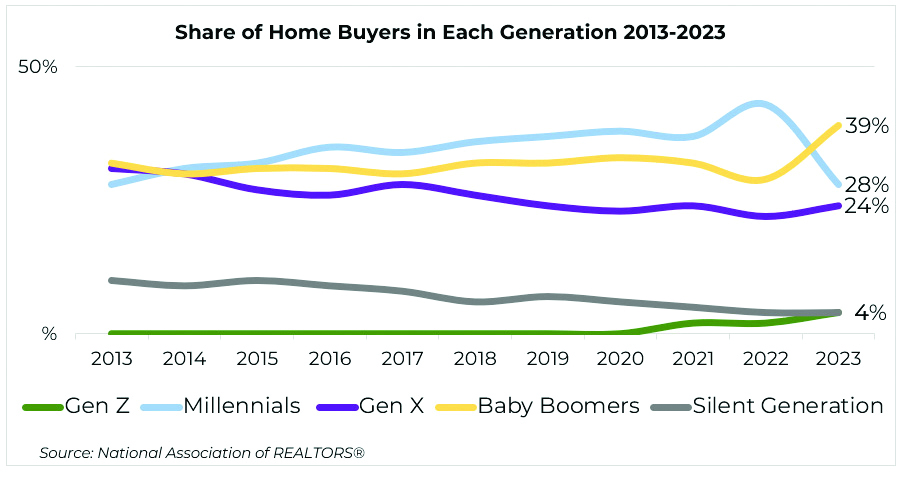

That leads to the last chart (see below). Even though millennials are the largest adult generation in the U.S. today, they represented a shrinking share of the market last year. This is at odds with what one would expect. That’s because most millennials have reached an age where a home purchase, or at least household formation, is typical. Yet, this year’s data shows that baby boomers overtook millennials as a share of the market. One clear reason is that older buyers have saved money and benefited from home-price appreciation, giving them the ability to pay all cash for a home purchase. With 51% of older boomers and 32% of younger boomers paying cash for their most recent purchase, boomers are the likely winner if there is a bidding war on a home.

For more information, visit https://www.nar.realtor/.

For more information, visit https://www.nar.realtor/.