There is no quantitative, universally recognized definition of a “buyer’s market” or a “seller’s market.” But that shouldn’t stop real estate professionals from recognizing or calling out when the balance of power has shifted—as it seemingly has in recent months.

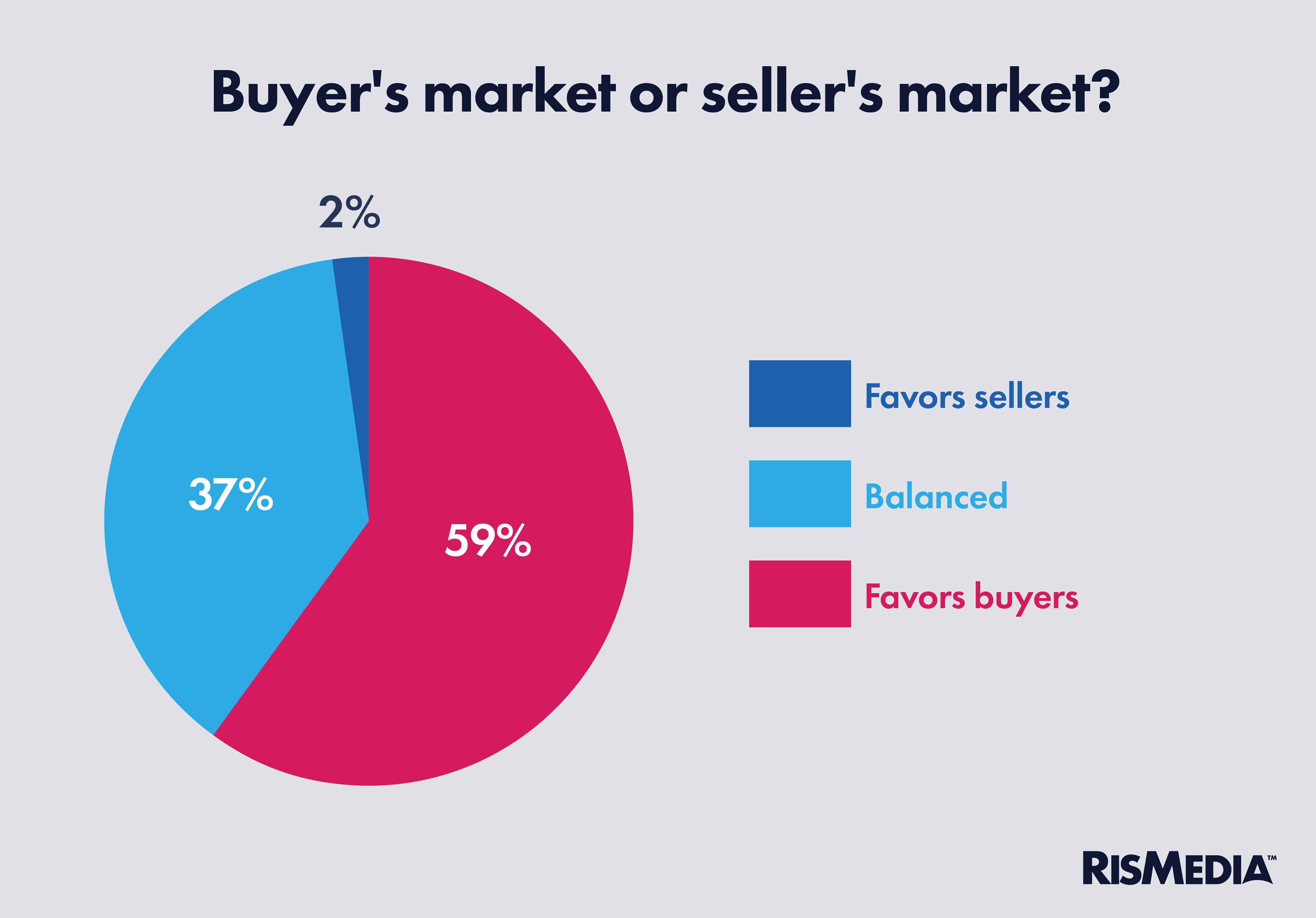

According to RISMedia’s most recent Broker Confidence Index (BCI) survey, most brokers feel their markets have entered a level of balance, after years of seller-favored dynamics in most places.

“The market is cyclical; it is either up or down still—or balanced—but (real estate is) still the best long-term investment,” said Terry Jones, broker/owner of HomeSmart Real Estate Associates in Washington. “Buying in a buyer-favored market is a no-brainer—it is (about) educating the client. More money has been made in real estate investing than all other investments combined.”

Almost two-thirds (65%) of brokers said their market was balanced, with most of the remaining respondents (32%) saying their markets were slightly buyer-favored. That affirms what data has shown, even though economists have also noted that broader macro uncertainty is suppressing demand as buyers eye a teetering labor market and tariff impacts.

Almost two-thirds (65%) of brokers said their market was balanced, with most of the remaining respondents (32%) saying their markets were slightly buyer-favored. That affirms what data has shown, even though economists have also noted that broader macro uncertainty is suppressing demand as buyers eye a teetering labor market and tariff impacts.

With continued uncertainty surrounding mortgage rates, brokers noted on-the-ground signs that consumers are still around and willing to move forward with transactions—under the right conditions.

“In the markets we represent, inventory remains high, more buyers are pending vs. the same period last year,” said Todd C. Menard, CEO of West USA Realty based in Arizona. “Stock market confidence is up since (Fed chair Jerome) Powell’s last presentation. Closings are 5% up vs. last year to-date, while median closed price is within $10k, meaning homes are no less affordable since the reset two years ago.”

Broker confidence overall clocked in at 7 (out of a maximum of 10) in October, exactly the same as the previous month. Despite the lethargic market, the BCI remains elevated compared to the same period in recent years, as confidence usually falls sharply at the end of summer.

Setting the bar

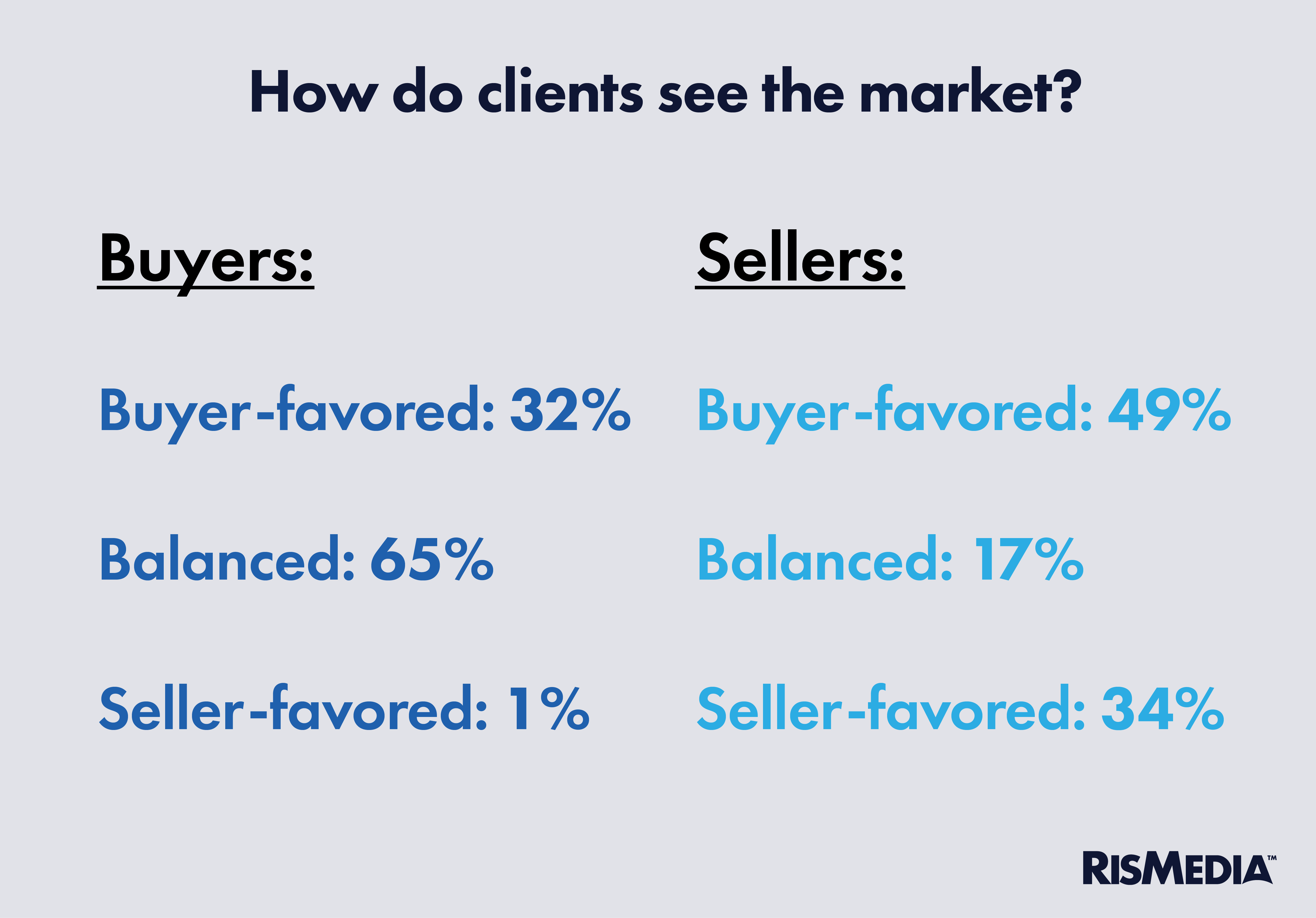

One of the most common frustrations real estate professionals encountered in the post-pandemic is clients—particularly sellers—whose expectations were not aligned with market realities, demanding fast sales and above-asking offers.

That misalignment appears to still exist, with brokers reporting that a significant portion of sellers still believe the market is in their favor.

While qualitatively, brokers did not report wildly unhinged expectations of instant sales above asking, the fact that sellers—and mostly sellers—still misread the market seems to indicate the persistence of the pandemic boom market in homeowners’ minds.

While qualitatively, brokers did not report wildly unhinged expectations of instant sales above asking, the fact that sellers—and mostly sellers—still misread the market seems to indicate the persistence of the pandemic boom market in homeowners’ minds.

Asked how they help set expectations, most brokers offered simple solutions: presenting the data and staying honest with feedback on pricing, days on market and demand.

Menard said that he uses a podcast and social media to compare “local insights” with the kinds of national data and expert commentary that doesn’t align with the regional market, drawing a contrast with the kind of headlines most people see.

Other brokers said they used more granular detail when setting expectations, and many highlighted the contrast between local and national trends, as Menard did.