When it’s time to file your tax return, you want to avoid owing money, if possible. The federal government rewards homeowners who make some renewable energy upgrades with tax credits.

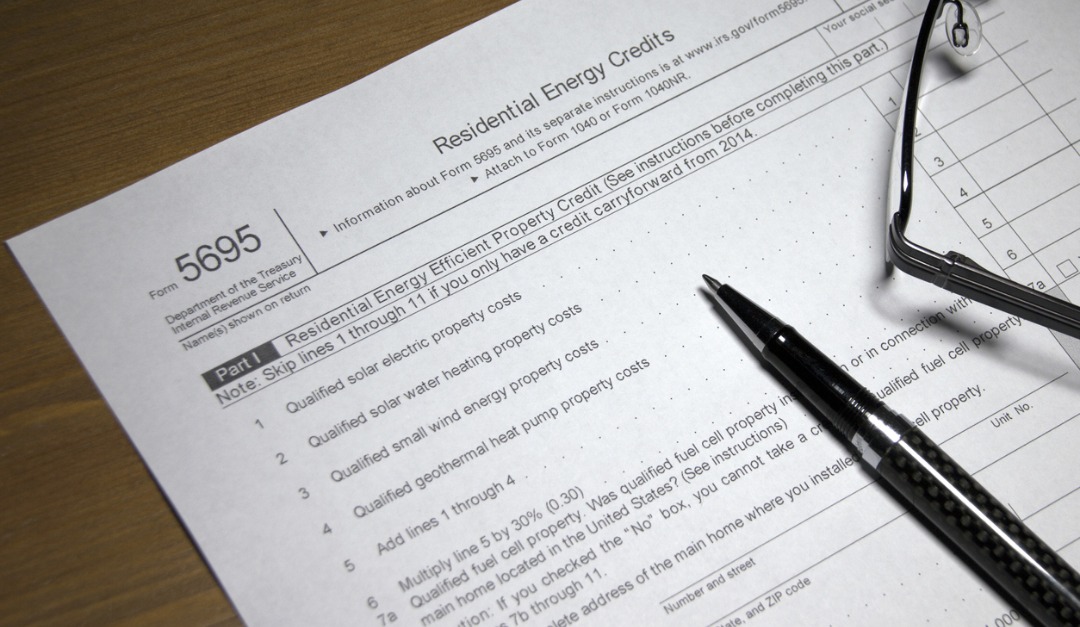

Resident Renewable Energy Tax Credit

This tax credit applies to solar, wind, geothermal and fuel-cell technology. Credits can be used to reduce your current or future taxes owed but are not refundable.

Solar, wind and geothermal technologies installed in a principal residence and/or a second home can qualify for tax credits. Solar panels must be used to generate electricity in the house. Solar-powered water heaters must be used in the home and at least half of the house’s water-heating capacity must come from solar power. Wind turbines that generate up to 100 kilowatts of electricity to be used in the residence qualify for tax credits. Geothermal heat pumps are eligible if they meet ENERGY STAR guidelines set by the federal government.

Fuel cells that use a renewable resource and generate at least 0.5 kilowatts of power qualify for tax credits. They must be installed in a primary residence.

You can deduct 30 percent of the costs for equipment installed in 2017, 2018 or 2019. The costs of both equipment and installation are eligible. There is no limit to the tax credit for solar, wind and geothermal equipment. For fuel cells, the tax credit is limited to $500 per half-kilowatt of capacity. The value of the credits will go down to 26 percent for equipment installed in 2020 and 22 percent for equipment installed in 2021.

Nonbusiness Property Tax Credit

This tax credit has been extended through December 31, 2020. To figure out if you qualify, you need to understand two terms the IRS uses.

“Qualified energy efficiency improvements” include insulation; exterior doors, windows, and skylights; and some roofing materials. “Residential energy property costs” includes electric heat pumps; electric heat pump water heaters; central air conditioning systems; natural gas-, propane- or oil-fueled water heaters, furnaces and hot water boilers; stoves powered by biomass fuel; and advanced circulating fans for furnaces fueled by oil, propane or natural gas.

Check with the manufacturer to make sure equipment and materials meet standards set by the Department of Energy to qualify for tax credits. The maximum tax credit is 10 percent of the cost of qualified energy efficiency improvements and 100 percent of residential energy property costs. You can get up to $200 in credits for windows, up to $50 for a furnace circulating fan, up to $150 for a furnace or boiler and up to $300 for any other individual residential energy property cost. The maximum total you can claim in tax credits is $500 for all tax years from 2006 through the expiration of the credit.

Get Professional Tax Advice

These credits may help you reduce your tax burden. If you have questions about whether equipment you installed in your home qualifies, the amount you qualify for in tax credits or any other tax-related matters, consult an accountant.