The United States real estate market is actually the envy of the world. The U.S. boasts the world’s most orderly, efficient and equitable housing market—and many other countries are attempting to emulate it.

Our system’s efficiency is driven in large part by agents and brokers competing aggressively, while also sharing their listing information with each other—and with the public—on an impartial basis. The local companies offering multiple listing systems (MLSs) around the country facilitate that process, while also giving brokers and their clients the option to offer to pay a finder’s fee—sometimes called a commission split—for the buyer’s broker. In turn, the real estate finance system has created relatively efficient processes for buyers to obtain loans, and for the costs of their real estate agent representation to be paid by the seller out of the transaction.

Unfortunately for the United States real estate consumer, this system is under attack by misguided lawsuits that allege the equitable, efficient, and highly competitive real estate marketplace in this country actually was created to artificially inflate commissions.

The first one of these cases, in Missouri federal court, recently concluded trial with the Missouri jury handing down a verdict in favor of the plaintiffs, a verdict we feel risks adversely affecting the ability for minorities and people of color to participate in the housing market.

After the conclusion of that first trial, the lead attorney for the plaintiffs was interviewed on CNBC, touting that homeowners were victims of a “rigged system,” and that compensation in real estate is different from any other industry—statements we found misleading and disingenuous.

Neither is correct.

A ‘rigged system’?

The system is indeed rigged, but not in the way he asserts. This country has a long and sordid history as it relates to discrimination in housing, and this discrimination comes from years of federal, state, and local policy and legislation aimed at enabling upward mobility for White Americans while hindering the ability of others to achieve the same homeownership objectives.

There have been mountains of studies and research done in this area, consistently finding that homeownership is the most effective way to build generational wealth and upward mobility in society.

A recent study by the Federal Reserve in 2020 found that homeowners in the United States had a net worth 40X that of renters. 40X.

To put that into real dollars and cents:

- Median net worth of US Homeowners: $255,000

- Median net worth of US renters: $6,300

That’s a staggering gap.

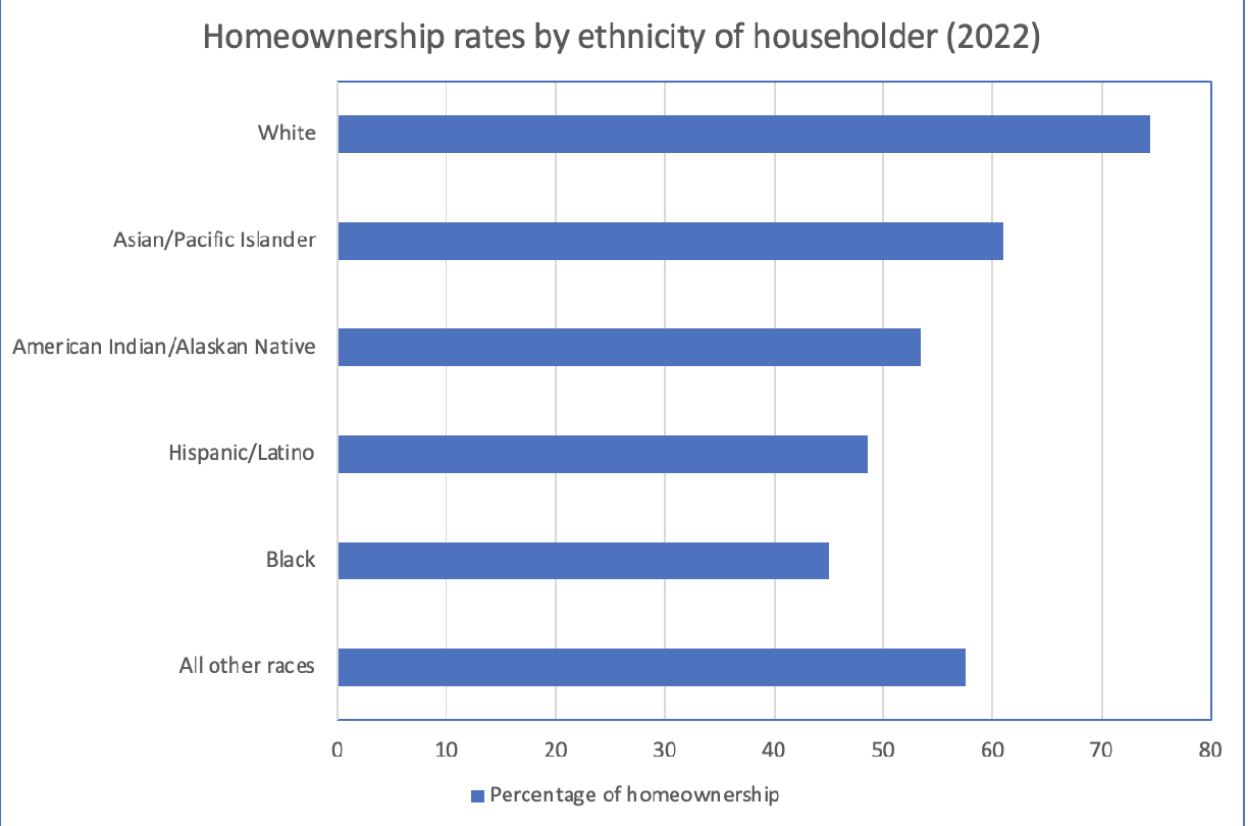

But it’s also a gap that favors white Americans, as rates of homeownership for whites far outpaces every other group:

Source: U.S. Census Bureau, 2022

And if the judge decides to prohibit sellers from paying a buyer’s broker fees, or if the DOJ tries to do the same, it will make it that much harder for folks in the “renters” category to move into the more lucrative “homeowner” category.

In a world where the current system of shared compensation was banned, buyers–especially first-time buyers–would be at a significant disadvantage in the property market.

The numbers are telling: Today’s median sales price hovers around $400,000, and in this scenario, prospective buyers need to bring between $14,000 – $80,000 to the table just as a down payment. This does not include all the other costs associated with a home purchase such as lender fees, appraisal fees, inspection fees, title and escrow fees—to name just a few.

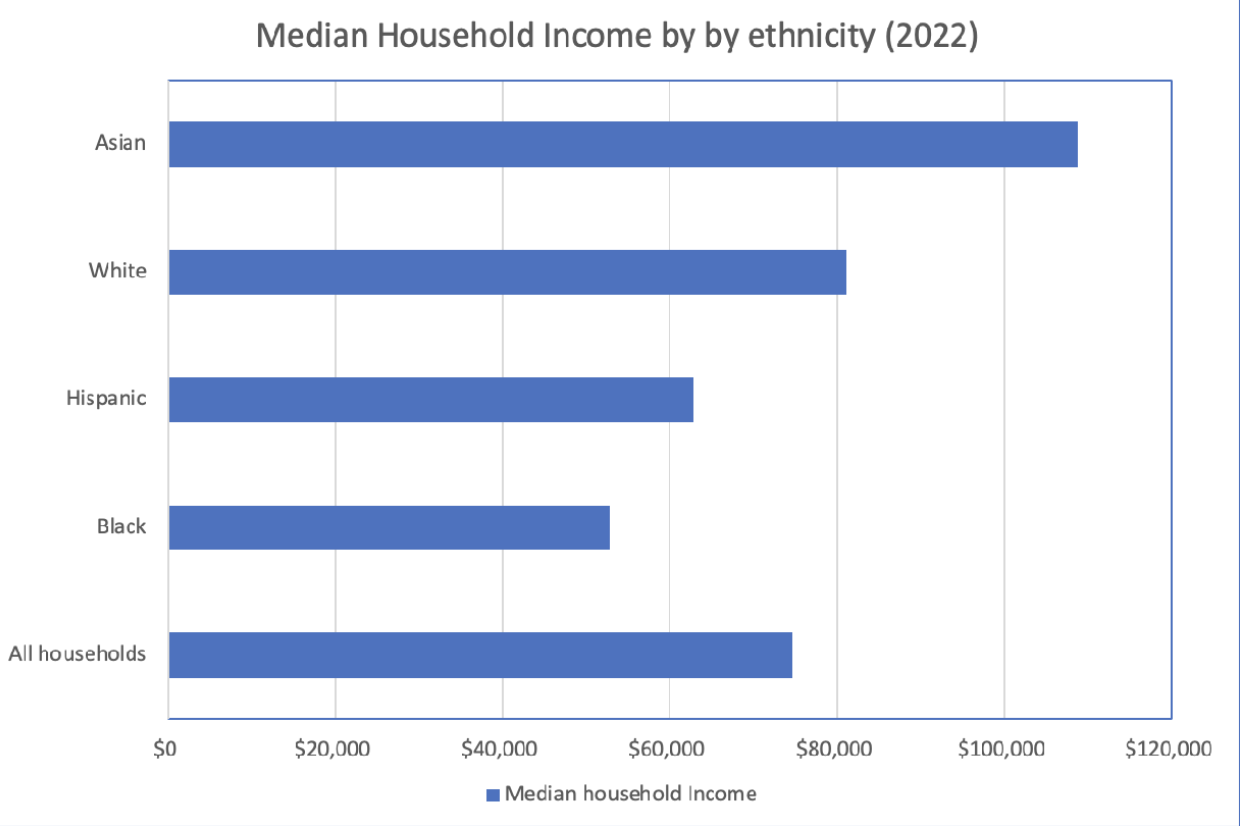

According to the U.S. Census Bureau, the median household income in the United States was $74,580 in 2022, so for the vast majority of Americans, a home purchase is already the most expensive and stressful transaction of their lives.

And it gets much harder if you are Black or Hispanic, as the median income for these cohorts are much lower than those of White Americans:

Source: U.S. Census Bureau, 2022

So, with a 20% down payment on a median priced home at $80,000, and the median household income at $74,580 (much less if you’re Black or Hispanic), the question remains: How is a buyer going to be able to pay for quality representation on the most expensive and stressful transaction of their lives, when the down payments required are potentially higher than their household’s annual income? They can’t be rolled into any loan products today, and it would take significant regulatory and financial institution policy changes to address that, any of which might be years away, if accomplished at all.

And if you happen to be Black or Hispanic, and if seller-paid compensation is no longer available, then the system seems even more rigged against you.

How are people–who have been discriminated against for decades in the United States–able to break into the property market when:

- The rates of homeownership for all minorities pales in comparison to the 75% of White Americans, and

- The median household income for Blacks and Hispanics is $20,000 – $30,000 less than Whites.

With those staggering disparities, how is it helpful to—or healthy for—a fair and equitable housing market to make an already expensive and stressful transaction even more expensive and stressful for the most disadvantaged?

Ultimately, if shared compensation were affected by this ruling, many buyers will be forced to forego representation altogether, or pay less for services that lack quality, ethical representation in the most complicated, expensive deal of their lives.

And this hurts people of color the most, as the more affluent, property-owning white population will be the least affected by this change—a change that will drive income and wealth disparity to staggering new heights.

Not to mention thrusting another shock into the housing system.

If the judge or the DOJ were to somehow stop seller-side commission sharing, it would not only inject risk into housing prices and buyer demand, but also have the potential to take this country back to the Dark Ages of real estate—when your ability to purchase a home was influenced so much more by what you look like, who you are, and who you know.

This is not hyperbole, it is happening right now.

Pocket listings and private networks of “exclusive” listings are on the rise.

“Exclusive” networks available to an “exclusive” set of buyers.

Brokerages and online real estate companies are already working to create closed systems of property information that are accessible based on… who you are, and who you know. Mostly to the detriment of the consumer, and the benefit of their bottom lines.

Are those “exclusive” services offered to clients, and then shared with prospective buyers, on an impartial basis? Nope.

One-sided compensation is unusual?

The lead attorney—who has now filed another case against more brokerage firms—made his closing argument on CNBC by asking, in what other industry do people pay for the other side’s services?

Well, Counselor, it’s actually YOUR industry.

In this case, the lawyer is not being paid by his clients, the plaintiffs he represents. Instead, the defendants will pay for both sides.

Sound familiar?

The plaintiffs’ lawyer is being paid in the same way buyers’ agents get paid today.

I guess that’s OK for the lawyer, but not the licensed real estate professional?

Of course, even without the MLS or a similar set of policies, other markets also work this way, such as employment recruiters (paid by the company looking for talent), as well as the commercial real estate market, where the seller also typically pays the buyer’s broker fees.

But without the efficiency of a centralized repository like the MLS, finding information about commercial properties is opaque, inefficient and expensive; and even without the MLS-facilitated offer of compensation, the commercial seller nearly always pays the buyer’s broker and nearly always at about the same split.

Do we want a less transparent, less efficient system for people’s homes, too?

Could brokerages and MLSs find ways to enhance their own transparency and efficiency?

Probably.

But that should not come at the price of putting up more barriers for any person—regardless of race, color, creed or sexual orientation—to access the housing market.

For more information, visit https://brightmls.com/open.